401k minimum distribution calculator

A Roth 401k is an account funded with after-tax contributions. As an example we will enter 100000 as the account balance.

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

However this course of action has to be completed within 60 days of the traditional IRA distribution.

. RMD is calculated based on life expectancy and the account balance at the end of the previous year. Use our 401k Early Withdrawal Costs Calculator first. 401k distribution tax form.

Determine how much your money can grow using the power of compound interest. To make paperwork easier you can also have the taxes withheld from your distribution 10 will automatically be held for federal taxes if you choose this option but you can elect to have. On your Form 1040.

Qualified distributions also include withdrawals at any age that go toward buying building or repairing your first home. Required Minimum IRA Distribution begins once the qualified account owner. 401k Save the Max Calculator.

You may owe additional taxes. If you were born on or after 711949 your first RMD will be for the year you turn 72. When you take a distribution from your 401k your retirement plan will send you a Form 1099-R.

On top of that the IRS will assess a 10 early distribution tax penalty and the conversion will ultimately not take place. John must receive his 2020 required minimum distribution by December 31 2020 based on his 2020 year-end balance. Depending upon the terms of your 401k or other employer plan you may be able to delay taking RMDs until April 1 of the year following the later of the.

Footnote 4 Distribution subject to immediate 20 federal tax withholding plus applicable state tax and possibly a 10 early-withdrawal additional tax if you are under age 59½ or under age 55 and separated from service. Your second and all subsequent distributions must be taken. How the Required Minimum Distribution is Determined.

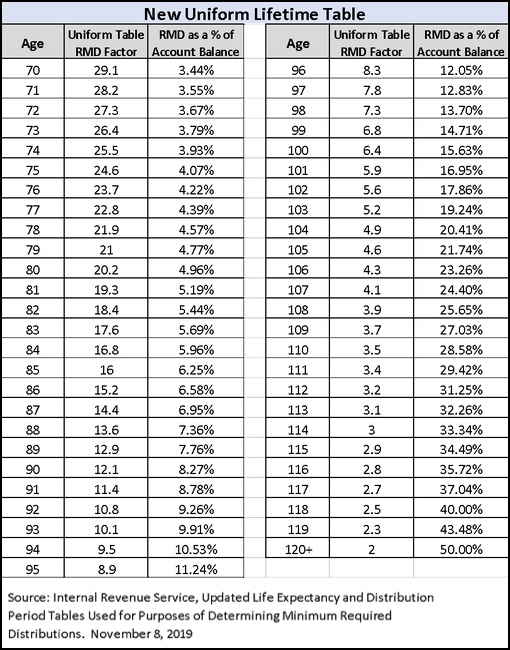

Taxes on 401k contributions. Required Minimum Distribution Calculator. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Traditional IRA vs Roth IRA. No taxes will be imposed on rollovers. An RMD is the annual Required Minimum Distribution that you must start taking out of your retirement account after you reach age 72.

If you dont take the required minimum distribution when youre supposed to the IRS can. This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. This is the amount of money that you must withdraw every year from the 401k account.

Enter amount in negative value. If John receives his initial required minimum distribution for 2019 on December 31 2019 then he will take the first RMD in 2019 and the second in 2020. You are generally allowed to take penalty-free distributions starting at age 59½.

It is perfectly acceptable to. Required minimum distributions from a traditional IRA or 401k plan are included in the taxpayers gross income and taxed as ordinary income except to the extent that the distribution includes after-tax contributions to the plan. Wwwirsgov Required Minimum Distribution RMD is the amount the IRS requires the owner of an Individual Retirement Account to withdrawal each yearTraditional IRAs SEP and SIMPLE accounts and employer sponsored retirement plans such as 401k plans are all subject to RMD.

This tax form for 401k distribution is sent when youve made a distribution of 10 or more. The amount is determined by the fair market value of your IRAs at the end of the previous year factored by your age and life expectancy. Or you can use a calculator like this one from T.

Note that each distribution must be at least the required minimum distribution RMD in order to avoid a penalty. A simple calculation determines the amount of the RMD. This tax form shows how much you withdrew overall and the 20 in federal taxes withheld from the distribution.

The 72t rule is once completing a rollover and a 72t is setup to pay out an income stream it must continue until the age of 59 ½ has been reached or for a minimum of 5 years whichever comes last. Your first required minimum distribution is due by April 1 of the year after you turn 72 70 12 if you were born before July 1 1949. When should I begin taking RMDs.

But do you know the true cost. For example someone withdrawing from a Roth IRA after reaching age 59½ is making a qualified distribution. Use our 401k calculator to see if youre on track for retirement.

For example if you start a 72t at the age of 57 it must run until you. If not the amount of the distribution minus any non-deductible contributions will be taxable in the year received. Traditional 401ks allow pre-tax contributions taxable withdrawals.

Or when you are considering rolling money over from a 401k to an IRA you may wish to roll over only a portion of your retirement savings and take the rest in cash. It is also possible to roll over a 401k to an IRA or another employers plan. The SECURE Act of 2019 changed the age that RMDs must begin.

However by April 1 of the year after you reach age 72 you are required to begin taking RMDs from your IRAs. Rowe Price to estimate your distribution you must take a minimum amount but you can always take out more. It may be tempting to pull money out of your 401k to cover a financial gap.

A qualified distribution from a Roth IRA meets all the requirements to be a tax-free withdrawal. Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals. The Bond Calculator can be used to calculate Bond Price and to determine the Yield-to-Maturity and Yield-to-Call on Bonds Bond Price Field - The Price of the bond is calculated or entered in this field.

Sjcomeup Com Rmd Distribution Table

Rmd Table Rules Requirements By Account Type

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

New Tables Are Available For Calculating Required Minimum Distributions Rmds In 2022 Julie Jason

Sjcomeup Com Rmd Distribution Table

Required Minimum Distribution Calculator Estimate The Minimum Amount

What Is A Required Minimum Distribution Taylor Hoffman

Required Minimum Distribution Calculator Estimate The Minimum Amount

Sjcomeup Com Rmd Distribution Table

Knowledge Base Required Minimum Distributions Rmd S Help Center Financial Planning Software Rightcapital

Ira Withdrawal Calculator Online 54 Off Www Ingeniovirtual Com

How Recent Changes To Required Minimum Distribution Rules May Affect Future Value Tsp Accounts

An Easy To Understand Guide To Required Minimum Distributions Retirement Field Guide

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

How Required Minimum Distributions Work Merriman

Required Minimum Distribution Rules Sensible Money

10 Ira Minimum Distribution Calculator Templates In Pdf Free Premium Templates